What’s the difference between a high and low credit score when it comes to a home mortgage?

With a high credit score you’ll usually save money on your mortgage. You’ll have more mortgage options, which can result in a lower mortgage payment and/or shorter term mortgage. But even if you have a lower credit score, there are many mortgage options available to you.

Credit Score Affect Your Ability to Qualify for a Mortgage

Lenders use you credit score to qualify you for a mortgage.

Your credit score tells lenders whether they should lend money to you. If you have a credit score below 580 (the minimum score for an FHA mortgage), it could be difficult to obtain a mortgage.

But don’t let a low credit score stop you from investigating your options. And, understand that minor changes in your credit structure can change your credit score enough to affect your ability to qualify for a mortgage.

Credit Score Affects What Types Of Mortgages You Qualify For

Lenders also use your credit score to determine which types of mortgages you qualify for. If lenders consider that you are a higher risk, they won’t be willing to offer you their least expensive mortgage products.

In most cases, if you have a credit score of less than 620, you won’t qualify for a conventional mortgage. But, there are numerous mortgage products you could qualify for, including an FHA mortgage.

Credit Score Affects Your Interest Rate

Lenders use your credit score to determine your interest rate. As a general rule, the higher your credit score, the lower the interest rate.

However, just because you have a high credit score, you won’t necessarily get a great mortgage rate. There’s more that goes into the price of a mortgage than just the interest rate, so watch out for additional factors like extra fees, mortgage insurance, lock-in periods, and so on.

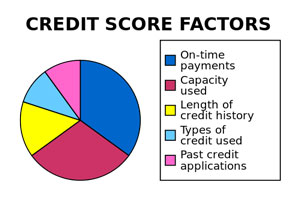

Your credit score tells a lender about what type of borrower you are. Generally speaking, a higher credit score means you’ll be able to borrow money at a lower interest rate. But if your score is low, don’t worry, there could be several things you can do to raise your credit score and qualify for a lower rate mortgage.

Take Away

In general terms, you will qualify for a lower cost mortgage if you have a higher credit score. But even if your credit score is low, there are often several things that can be done to improve it, and qualify for a mortgage.

Many home owners have had a lower credit score at sometime in life, but that shouldn’t stop you or pursuing your dream of homeownership. There are a lot of mortgage options, such as VA, FHA, and USDA.

[text-blocks id=”2497″ plain=1]

The Marimark Mortgage Newsletter will keep you informed with important events in the mortgage industry that could impact your finances.

We especially focus on ways to save money on your current and future mortgages. And, we continually share the information we share with our clients, because we believe informed consumers are the best consumers.

Real estate agents, and other professionals in the industry, will receive an ongoing wealth of information that will help them serve their clients.