Obtaining a mortgage is an essential step toward homeownership, though navigating the lending process can be complex. At the core of this process is your credit score. Understanding this three-digit … [Read more...]

How to Pay Off Your Debt and Improve Your Credit Score

Debt is an issue that many people deal with daily. Keeping up with your finances and moving toward financial freedom with credit card debt, school loans, and personal loans can be challenging. You're … [Read more...]

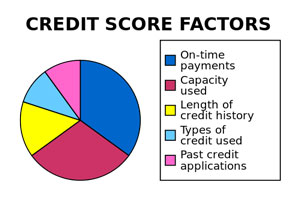

How Can You Improve Your Credit Score?

Your credit score is essential, as it tells mortgage lenders how financially responsible you are. If you want to boost your credit score, there are many ways to do so. While it may take some time … [Read more...]

Homebuyers with Excellent Credit Scores Save Thousands of Dollars on Their Mortgage

It’s common knowledge that having a good credit score will help you get a better interest rate on your mortgage. However, a new study has shown that a good credit score can save homebuyers tens of … [Read more...]

6 Simple Ways To Raise Your FICO Credit Score

A high FICO credit score helps in several ways regarding your ability to borrow money. Best of all, a high credit score typically results in a lower mortgage payment and/or a shorter term. While it … [Read more...]

4 Tips to Raise Your FICO Score to Qualify for a Mortgage and Secure a Better Mortgage Rate

Raising your credit score can help you qualify for a mortgage and secure a better mortgage rate. And for many people, making a few financial adjustments can raise their FICO score, resulting in a … [Read more...]

Missing 1 Mortgage Payment Affects Your Credit Score. Here’s What You Can Do.

Missing a single mortgage payment can serious impact your credit score. But the good news is that there are things you can do to mitigate the damage. Own Up To The Mistake The best thing to do is to … [Read more...]

Your Credit Score Affects How Much You’ll Pay for a Mortgage

What's the difference between a high and low credit score when it comes to a home mortgage? With a high credit score you'll usually save money on your mortgage. You'll have more mortgage options, … [Read more...]

Want a better credit score? Here are 5 easy steps.

As a mortgage broker, we constantly work with credit scores. And often times, clients want to know what they can do to improve their credit scores. 5 Easy Steps to a Higher Credit Score So here is a … [Read more...]

7 Credit Score Misconceptions

There are several misconceptions about credit scores. Some of these misconceptions involve getting a mortgage with bad credit, and others involve getting a mortgage with good credit. Peter Andrew, … [Read more...]