A high FICO credit score helps in several ways regarding your ability to borrow money. Best of all, a high credit score typically results in a lower mortgage payment and/or a shorter term.

A high FICO credit score helps in several ways regarding your ability to borrow money. Best of all, a high credit score typically results in a lower mortgage payment and/or a shorter term.

While it is impossible to change your credit score “on the spot,” there are strategies to implement that will increase your credit score over time!

So, here are 6 simple things you can do to raise your credit score and keep it as high as possible.

#1 Check Your Credit Report and Correct Mistakes

In 2013, the Federal Trade Commission reported that one in four consumers in a study had found errors in their credit reports that were sufficiently serious to materially affect their scores.

So, checking your credit report and correcting mistakes is very important to having a high FICO credit score.

Note: Theoretically, if a series of credit reports is requested on your behalf during a limited amount of time, your score goes down until time passes without any inquiries. Changes in the law though have made “consumer-originating” credit report requests not count so much.

#2 Use Credit & Use Different Types of Credit

A common mistake by consumers is not using credit, which results in an inadequate credit history and low credit score.

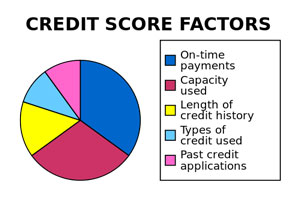

Here is the way the FICO score model is made up:

- Payment History: 35%

- Amount Owed: 30%

- Length of Credit History: 15%

- New Credit: 10%

- Types of Credit in Use: 10%

To have a good credit rating, a consumer must show their ability to use credit. A consumer that does not use credit will not have a credit history, and will not have a good credit score.

Besides using credit in general, it’s also helpful to use different types of credit. For example, use a combination of installment loans (e.g., auto loans and mortgages) and revolving credit (e.g., bank credit cards, retail store credit cards, gas credit cards).

#3 Judiciously Apply for New Credit

There are two important things to keep in mind when thinking about applying for credit:

- A lender checking your credit report can decrease your score by 10-20 points.

- “New Credit” accounts for 10% of your FICO score.

As a result, applying for credit can lower your credit score, even if you are turned down. The FICO model treats consumers who are actively seeking credit as a higher risk than consumers who are not seeking credit.

And if you are approved for the new credit, your credit score is negatively impacted because the FICO model includes an evaluation of the age of your open credit accounts.

Therefore, it’s recommended that you try to use existing credit resources as much as possible, rather than opening a new credit account. And furthermore, when applying for new credit, only apply for credit when you are certain you will be approved.

#4 Keep Balances Low Relative to Credit Limits

The FICO model evaluates your percent of credit utilization. If you are maxed out with your credit accounts, your credit score will be lower than when you’re using just a small percent of your available credit.

The best way to manage your credit is to be aware of your credit limits and make sure that the balances on your revolving accounts are low in relation to the allowed limit. This is referred to as “credit utilization” and is calculated by adding up the balances of all revolving credit accounts and dividing it by the credit limit of all revolving accounts. Lower credit utilization is positive for your score, and higher credit utilization is negative.

#5 Don’t Close Old, Unused Credit Accounts

Since the FICO model takes into account the age of credit accounts and the percent of credit utilized (above), you want to keep old credit accounts open, even if you are not using them.

Closing old credit accounts, especially credit card accounts, can lower your overall FICO score by decreasing the average age of your accounts and increasing the percent of credit utilization.

#6 Make Sure Bills are Paid on Time

Sometimes borrowers are late paying their bills because of an oversight. They have the money, but the bill is not paid on time.

Payment history accounts for 35% of the FICO score. So, a late payment by a borrower for any reason has a negative impact.

Missing a single mortgage payment can seriously impact your credit score, and should be dealt with immediately. Here is what you can do if you miss a mortgage payment.

If you cannot pay the debt, but make arrangements to pay the debt, it could be structured with some creditors to show that you are current on your payments. This could have a huge impact on your credit score and help you qualify for a better rate on a home loan.

Take Away

Knowing how the FICO credit score model works, gives you insight into the simple things you can do to raise your credit score and keep it as high as possible.

In the end, a high credit score can give you more credit options, save money, and help you achieve your financial goals.

Marimark Mortgage

Marimark Mortgage is based in Tampa, Florida, and serves the mortgage needs of homebuyers, homeowners, and investors in Florida, Virginia, and Pennsylvania.

We specialize in mortgages for first-time homebuyers, conventional home mortgages, refinance loans, reverse mortgages, and FHA, VA, and USDA mortgage options. In addition, we’ve worked extensively with cash-out refinancing and help clients to lower their monthly mortgage payments.

To get started with a mortgage to buy your next home, please fill out our Quick Mortgage Application or contact us.

The Marimark Mortgage Newsletter will keep you informed with important events in the mortgage industry that could impact your finances.

We especially focus on ways to save money on your current and future mortgages. And, we continually share the information we share with our clients, because we believe informed consumers are the best consumers.

Real estate agents, and other professionals in the industry, will receive an ongoing wealth of information that will help them serve their clients.