The final stretch of the home-buying journey—the closing process—can often feel like the longest. Between accepting the offer and receiving the keys, a complex series of steps must unfold perfectly. … [Read more...]

What to Expect When Applying for a Mortgage

Applying for a mortgage can feel like navigating a complex maze of paperwork, jargon, and uncertainty. This comprehensive guide will illuminate the path, outlining what you can expect at each step, … [Read more...]

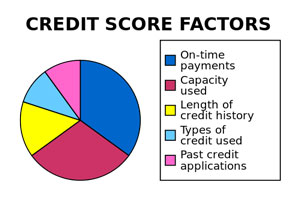

Tips for Improving Your Credit Report

Your credit score is more than just a number; it's a reflection of your financial health and a critical factor in determining your access to loans, credit cards, and favorable interest rates. Whether … [Read more...]

Lower Your Monthly Mortgage Payment and Put More Cash in Your Pockets

Managing a mortgage is a significant aspect of homeownership, and reducing monthly payments while freeing up extra funds can be enticing. Whether you're a seasoned homeowner looking to ease your … [Read more...]

Invest The Time To Find The Best Mortgage

-+ Investing in a home is one of the most significant financial decisions a person can make. Whether you're a first-time homebuyer or looking to refinance, finding the best mortgage is crucial to … [Read more...]

4 Reasons to Consider a 15-Year Mortgage

When looking to purchase a home, you will realize you have many decisions to make. First, you must decide on a mortgage lender and loan that suits your financial circumstances. One major decision is … [Read more...]

Advantages and Disadvantages of an FHA Home Mortgage

Deciding which mortgage is right for you can be challenging. However, researching and learning what each type of loan offers can help borrowers make the best choice based on their financial … [Read more...]

What Type of Closing Costs Should You Expect to See When Buying or Refinancing a Home?

When you are purchasing or refinancing a home, there are certain closing costs that you should expect to see on your closing statement (HUD settlement statement). So that you are aware of these fees, … [Read more...]

Mortgages for Investment Properties

Though buying an investment property and getting it on the market to produce an income has several parts, arranging for financing is often at the top of the list. An investment property mortgage with … [Read more...]

Tax Reform Expected to Boost Housing Demand

Thanks to recent tax reform, we are already experiencing a boost to the economy resulting in economic growth. According to a recent Fannie Mae Economic and Housing Outlook, increased business … [Read more...]

- 1

- 2

- 3

- …

- 10

- Next Page »