Refinancing a mortgage can be a strategic financial move for homeowners, offering a range of potential benefits that make it a compelling option. Whether aiming to lower monthly payments, secure a … [Read more...]

How to Get Pre-Approved for a Mortgage

In the thrilling journey of homeownership, the initial step holds profound significance – obtaining a mortgage pre-approval. Mortgage pre-approval streamlines the house-hunting process and empowers … [Read more...]

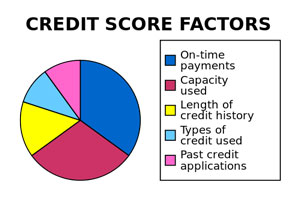

Tips for Improving Your Credit Report

Your credit score is more than just a number; it's a reflection of your financial health and a critical factor in determining your access to loans, credit cards, and favorable interest rates. Whether … [Read more...]

Top Things to Avoid Before Applying for a Mortgage

Applying for a mortgage is a significant financial step that often marks the realization of homeownership dreams. Whether you're a first-time homebuyer or looking to refinance, securing a mortgage is … [Read more...]

Mortgage Myths Debunked

Many mortgage myths are floating around, partly because mortgages can be complex and confusing. As with every complex topic, mortgage myths can result in borrowers having flawed or incomplete … [Read more...]

How Will a Job Change Affect My Ability to Qualify for a Home Loan?

In the grand scheme of life's transitions, changing jobs ranks high on the list of significant moves. Whether pursuing a new career path, seeking better opportunities, or relocating for personal … [Read more...]

What is Your Debt-to-Income Ratio, and Why is it Important in Qualifying for a Mortgage?

For many, the prospect of homeownership stands as a beacon of financial achievement. That moment when you step into a house with the comforting knowledge that it's yours, to decorate, inhabit, and … [Read more...]

4 Ways to Remove Private Mortgage Insurance

Private Mortgage Insurance, often termed PMI, is a financial safeguard lenders typically require when a homebuyer's down payment is less than 20% of the property's value. While PMI serves a valuable … [Read more...]

Information You Need to Know About Mortgage Loans

Navigating the world of mortgages can be overwhelming, especially for first-time homebuyers. Understanding the intricacies of mortgage loans is crucial for making informed decisions that align with … [Read more...]

What You Need to Know About Mortgage Forbearance

Mortgage forbearance is when your mortgage lender allows you to pause or reduce your mortgage payments for a limited time because of financial hardship. Many homeowners experience unexpected … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 49

- Next Page »